KYC for Content Creators: Building Trust and Ensuring Safety

Content creation has become a powerful medium for sharing ideas, information, and creativity. The reach of content creators, whether it be bloggers, YouTubers, podcasters, or social media influencers, is expanding rapidly. With this expansion, many of them are also moving to content monetisation platforms. Housing many creators and their fans, these platforms create demand for transparency and safety in the online world. This is where Know Your Customer (KYC) comes into play. In this blog post, we will explore why content creation needs to embrace KYC to build trust, protect audiences, and ensure credibility.

Why KYC Matters for Content Platforms & Creators

It’s important to note that when we talk about KYC measures for content creators, we mean services that house these creators. Better-known examples of this would be such services as Patreon, Udemy, Substack or OnlyFans. However, when you look at it at a wider scale, social media platforms like Instagram or X are moving toward similar subscription-based content models. Many services have already implemented KYC measures, however, some still hesitate to do so.

KYC processes create three layers of protection. Let’s take a look at them here:

Platforms

The most important part of KYC implementation deals with Anti-Money Laundering (AML) requirements. As any business that deals with transactions, platforms that house these creators are required to adhere to AML regulations. This ensures both the platform and its users are protected from crimes such as terrorist financing, money laundering, and overall criminal transactions. Failing to comply with AML requirements not only exposes content monetisation platforms to potentially harmful users but also threatens them with AML fines. On average, companies spend $14.82 million on AML fines.

Creators

Creators on content monetisation platforms rely on the service to earn a living from their content. Verification processes can deter bad actors from impersonating creators and spreading harmful content, thus fostering a healthier and more respectful online environment. It also protects creators from their content being stolen and used by others to gain their hard-earned funds. On top of this, by ensuring that users are who they claim to be, these services can reduce the likelihood of chargebacks and fraud, which can have a devastating impact on creators’ income.

Users

One of the primary reasons why content monetisation platforms should use KYC is to verify their authenticity. With an influx of online personalities, it has become increasingly difficult for audiences to distinguish between genuine content creators and potential imposters. By implementing KYC procedures, content creators can validate their identity and establish a sense of trustworthiness with their audience. On top of this, KYC measures ensure malicious actors cannot impersonate creators to deceive audiences, leading to financial or personal harm. Content creators can ensure that their audience knows who they are interacting with, reducing the chances of falling victim to fraudulent schemes. This protects the audience from giving money to people they do not trust.

How KYC Safeguards Creators from Abuse & Fraud

Creators on subscription-based services rely on the platform to earn a living from their content. KYC procedures can help protect these creators from potential harm. By ensuring that users are who they claim to be, these services can reduce the likelihood of chargebacks and fraud, which can have a devastating impact on creators’ income. This added layer of security allows creators to focus on what they do best—creating content—without worrying about financial risks.

Best KYC Methods for Monetization Platforms

When looking at KYC procedures for these platforms, there are two main factors that need to be considered. First, it is incredibly important that the process is extensive and gathers all necessary data. The second factor is how convenient the process is for both creators and users.

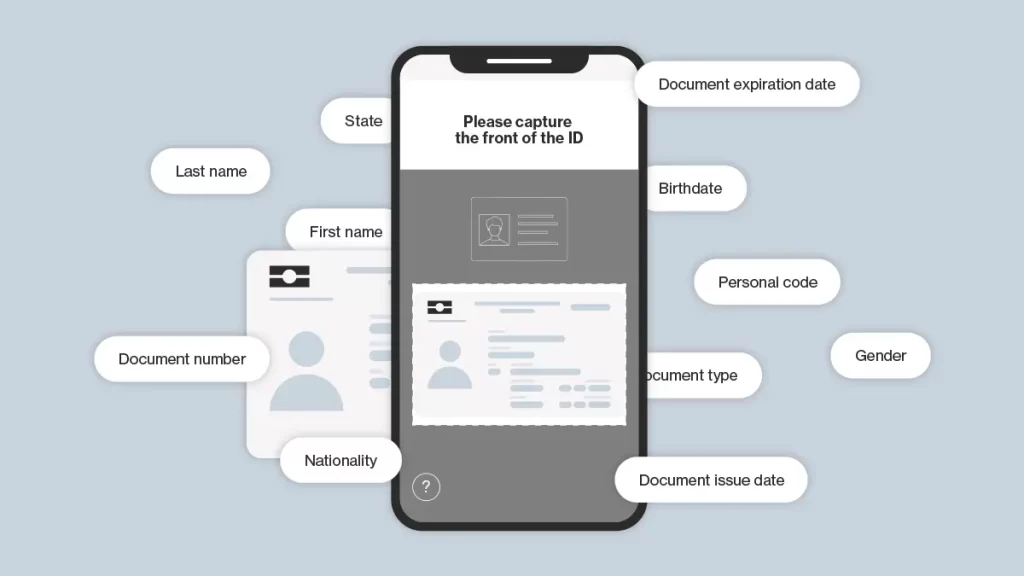

In our years of experience working with the platforms, we found that the solution that works for them most often is automated identity verification.

Our automated identity verification brings a few benefits. It is quick, as verification can be completed in just 60 seconds, and the clients can move on to the platform in no time. The use of AI allows users to complete verification completely independently, which means it can be done anywhere, at any time. With our ID spoofing checks, extensive registry checks and biometric face comparison, it is as efficient and secure as you can get.

Key Takeaways

In conclusion, content creators need to embrace KYC as an integral part of their online presence. KYC procedures not only verify authenticity and build trust but also protect both creators and their audiences from potential scams and fraud. Compliance with legal requirements strengthens a creator’s position in the industry and fosters better relationships with brands. By adopting KYC, content creators play a crucial role in creating a safer and more reliable digital community. Ultimately, it’s an investment that benefits both creators and their followers, safeguarding their shared passion for quality content and meaningful interactions.